[最も好ましい] no 1099 issued 103312-No 1099 issued reddit

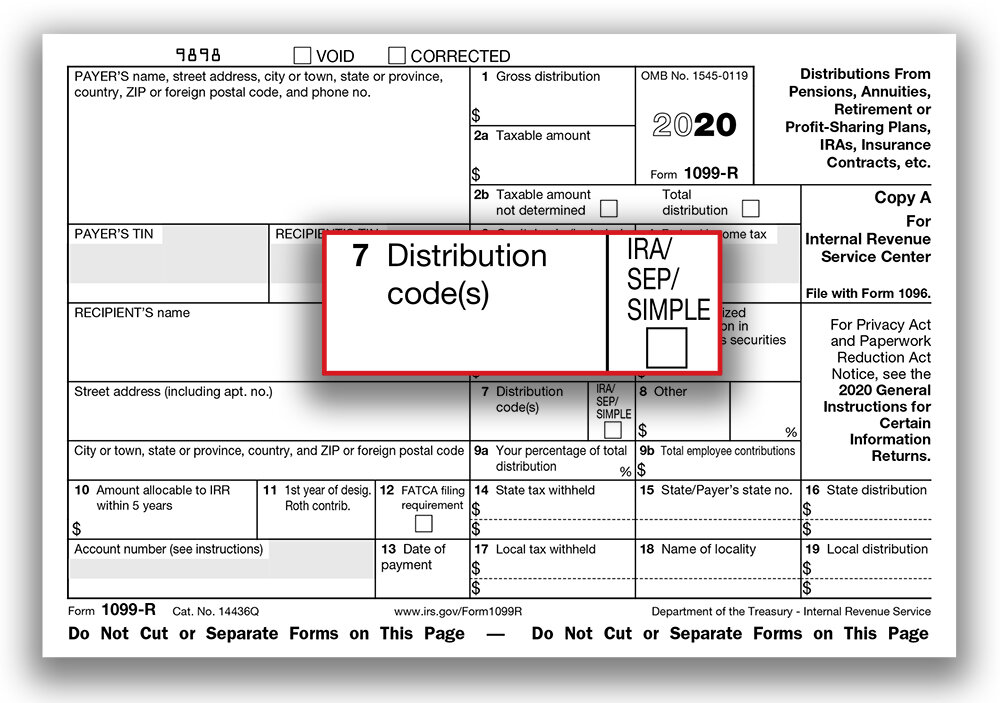

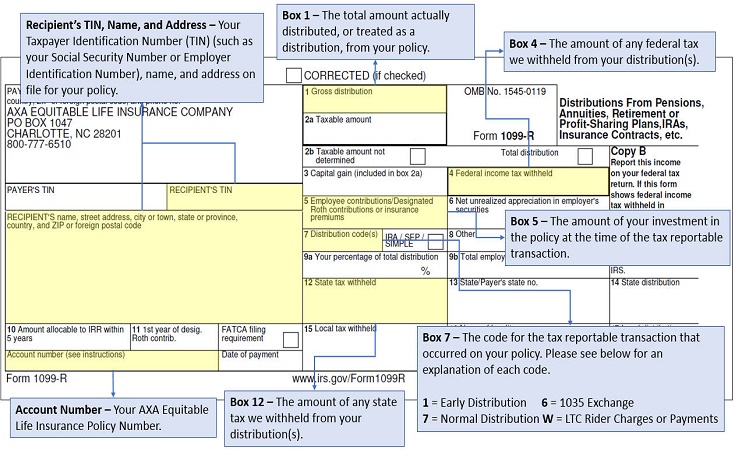

0807 · 1099 contractor is a person who works independently rather than for an employer Have significant differences in the legalities of a contractor and employee Toggle navigation How It Works; · I've done this 50 times with clients and the original IRA institution always sends a 1099r for the transfer I recently did the same thing with a client Did a trustee to trustee transfer from company A to Company B, IRA to IRA, and company A is now saying that because this was a trustee to trustee transfer, they will not generate a 1099r for the clientIRS Form 1099C The IRS considers forgiven loan debt to be taxable income gained by the borrowers benefiting from such forgiveness A home's short sale for less than its

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

No 1099 issued reddit

No 1099 issued reddit-No need to spend hours finding a lawyer, post a job and get custom quotes from experienced lawyers instantly2517 · Ordinarily the answer would be no, since the Form 1099MISC is issued only to nonemployees who receive compensation of $600 or more from the church during the year IRS Letter Rulings , To the extent that benevolence distributions to a particular individual represent a legitimate charitable distribution by the church

3

0416 · 1099 issued to deceased instead of estate , 05 AM If a deceased person receives a pension check after they have passed I understand that an estate income tax return is necessary (if the amount is over $600) What do IIf your Form W2, Wage and Tax Statement and/or Form 1099R, Distributions From Pensions, Annuities, Retirement or ProfitSharing Plans, IRAs, Insurance Contracts, etc aren't available to you by February 1, 21, or if your information is incorrect on these forms, contact your employer/payerIf you still haven't received the missing or corrected form by the end of February, · No, but maybe?

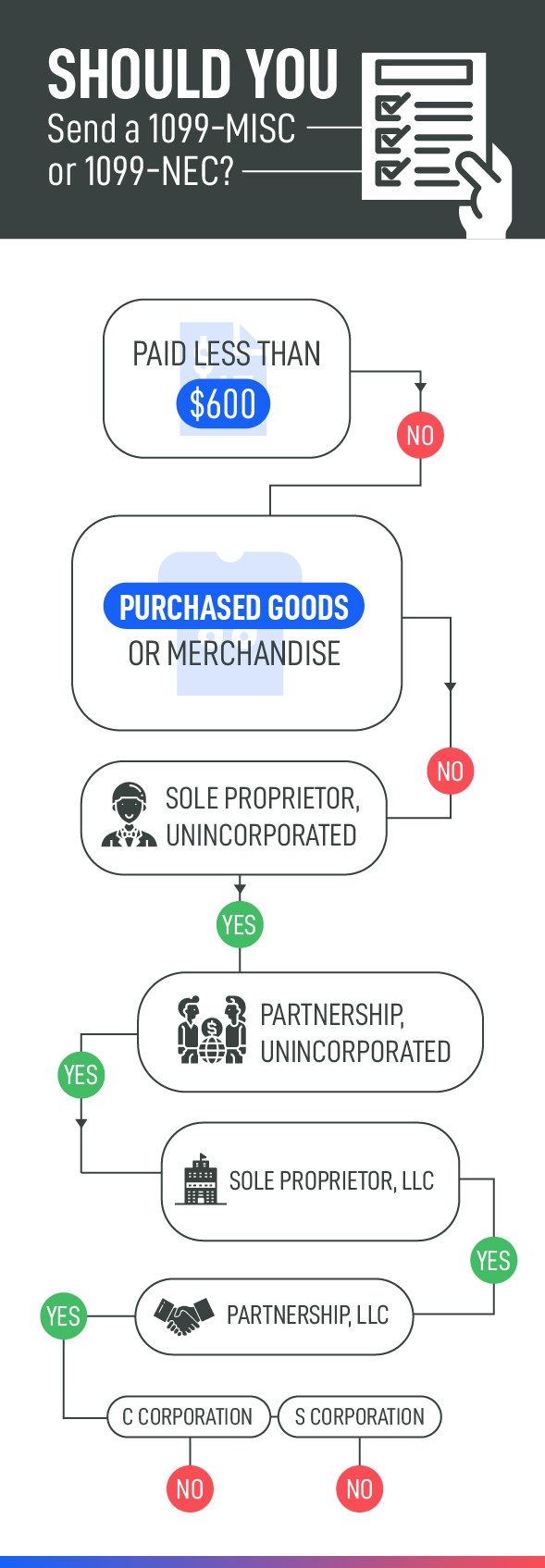

· You have no control over an employer not giving a 1099 Even without the form, report the income you received with your other gross receipts on Schedule C · Yes you do From the IRS site It is a common misconception that if a taxpayer does not receive a Form 1099MISC or if the income is under $600 per payer, the income is not taxable There is no minimum amount that a taxpayer may exclude from gross incomeA 1099 form is used to document wages paid to a freelance worker or independent contractor While many business owners aren't sure when to issue a 1099 form to an independent contractor, doing so is an important part of tax compliance Here's what you need to know about this important documentation for freelance workers

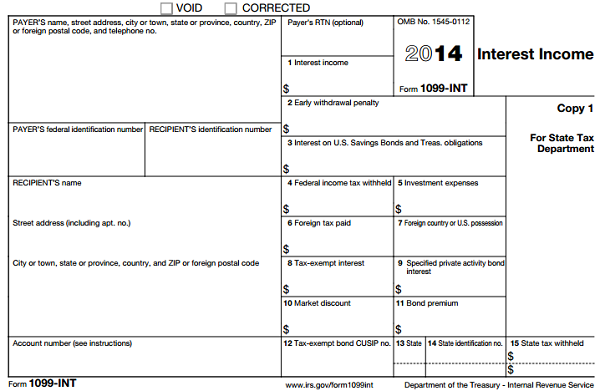

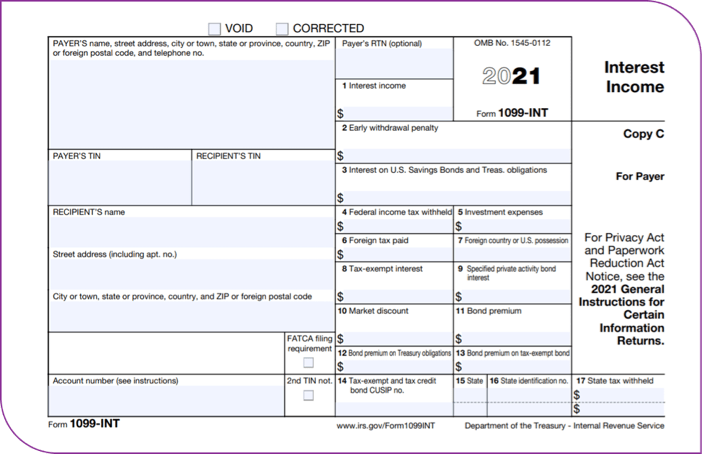

· Yes, you can still report your Interest Income without a 1099INT To enter your Interest Income, please complete the following steps below Sign in to TurboTax (if you're not already signed in) Click on the Take me to my return button; · The IRS requires 1096 and 1099 to be issued Click here to Download Pdf The general information reporting requirement for payments of $ or more does not apply to persons who receive rental income from real estate who are not otherwise engaged in the trade or business of renting property · You can file your tax return without 1099 forms The IRS has several ways of tracking your earnings via Form 1099 Expect to get one if you

Users Cannot Retrieve Tax Documents From Florida Deo Website Wtsp Com

Understanding Tax Form 1099 Int Novel Investor

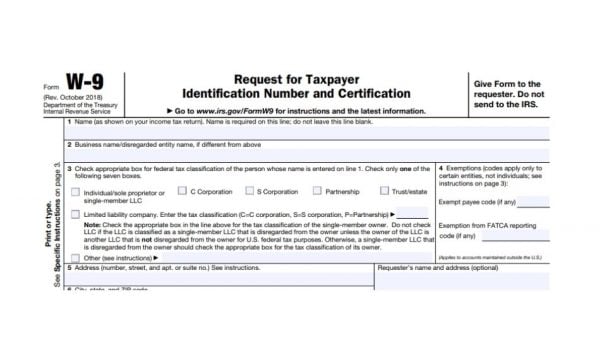

1219 · If you don't get a 1099 in the mail, you can still report your miscellaneous income You don't need the form Your payers should send one, but there are some instances where they simply don't send one For that reason, it's important to track your · By signing Form W8BEN, the foreign contractor is certifying that he or she is not a US person The Form W8BEN is not filed with the IRS It is kept on file with the US payor in case the US payor is audited If audited, the Form W8BEN supports why no Form 1099 was issued and why no tax was withheldOur Lawyers Did you know?

Who Gets A 1099 Misc What You Need To Know About Contractors Small Business Trends

What Is A 1099 And Why Did I Get One Toughnickel

· According to the law, a Form 1099 should only be issued for amounts of $600 or more If you've earned less than that, the paying company doesn't need to send out the form Now, let's consider the possibility that you earned more than $600, but still didn't get your Form 1099 In this case, you're required to make an effort to get the formThe penalty for not issuing a Form 1099 is $250 per 1099 If you file 1099's late the penalty is $50 or $100 per 1099 depending on how late they are filed Example If you have paid 10 unincorporated businesses more than $600 in 15 and don't file the required 1099's, the IRS can access a whopping penalty of $2,500 Introducing The 1095In case of payment for personal services (ie, payment for services that fall outside a business−contractor arrangement, such as payment for household help), no Form 1099MISC needs to be issued if the payee is a resident alien, but Form 1042S must be issued in the case of nonresident payees

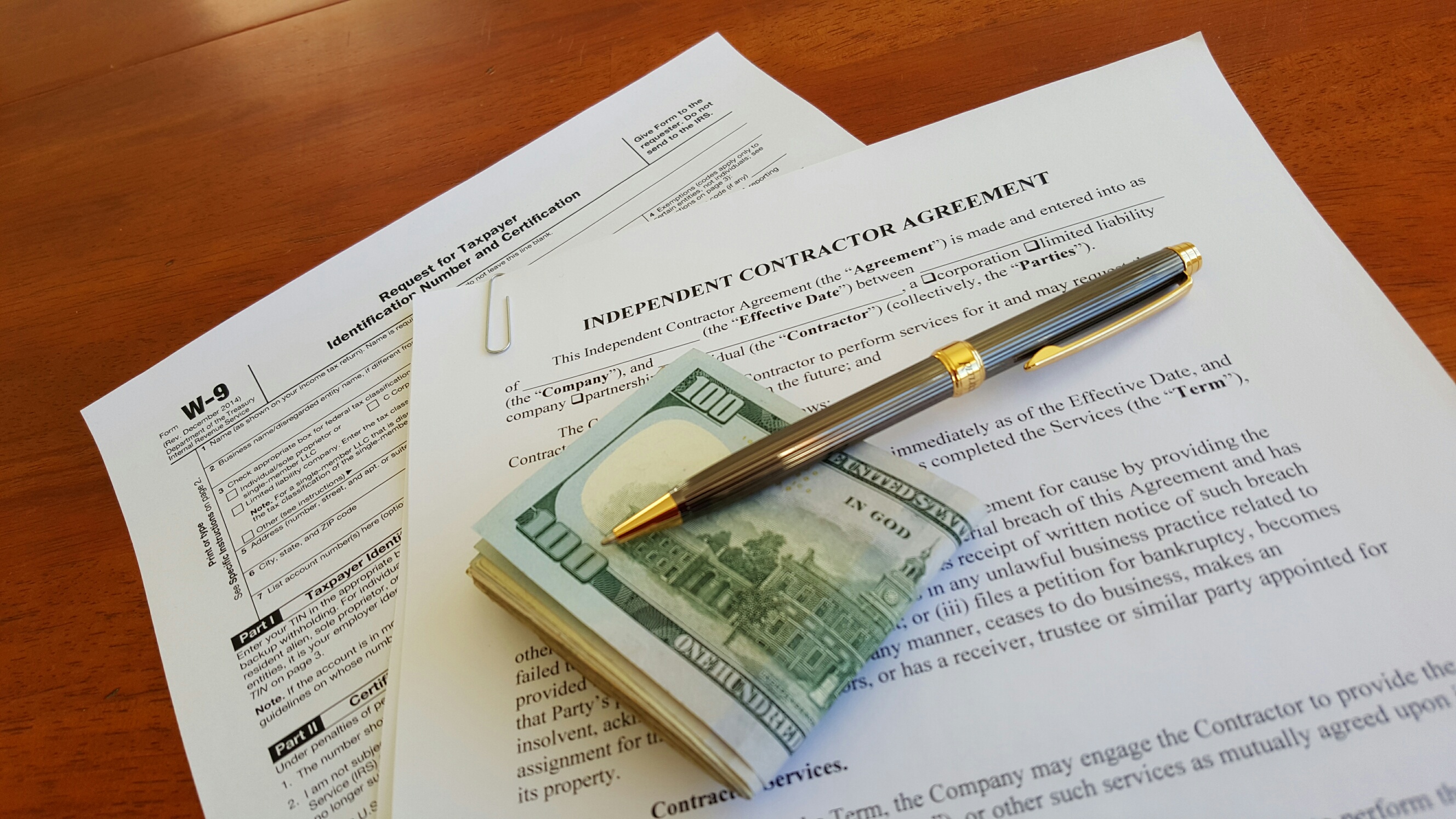

W9 Vs 1099 Irs Forms Differences And When To Use Them

What Is A 1099 G Zipbooks

· Nothing in Section 162 or Cohan requires a Form 1099 to be issued for a subcontractor labor expense to be deducted You just need to prove you paid the expense in the operation of your business Proof can be direct (a check) or · The proper action is to prepare a pseudo1099INT from that bank, and enter the interest earnedirrespective of whether the bank issued a 1099INT or not *Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice* View solution in original post 0If the damages were less than $600, the payee is not required to provide you with a 1099 If the settlement you received was not subject to taxes, as is the case with damages awarded for a physical injury or illness, you should not receive a 1099 If you are awarded back pay, you'll receive a W2 reporting that amount

When Are You Required To Issue A 1099

Florida Deo From Now Until January 31 21 1099 G Forms Are Being Issued To Claimants Who Received Reemployment Assistance Benefits During These Forms Will Be Issued Through Connect Or

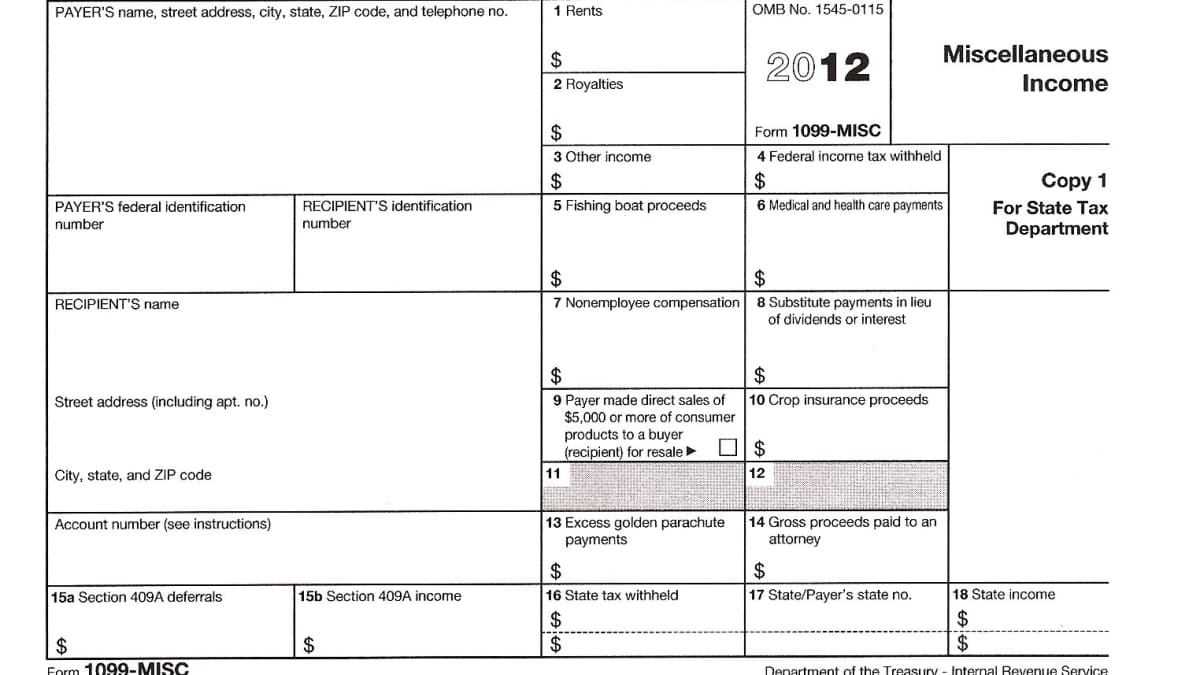

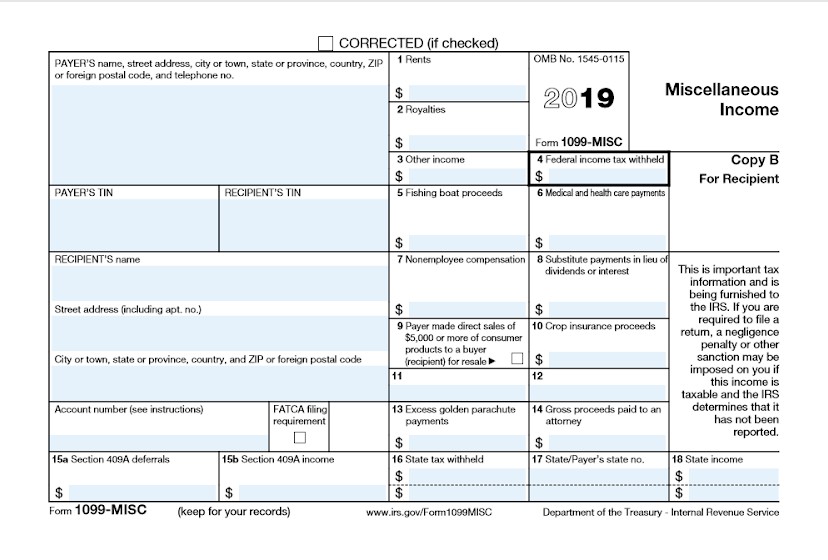

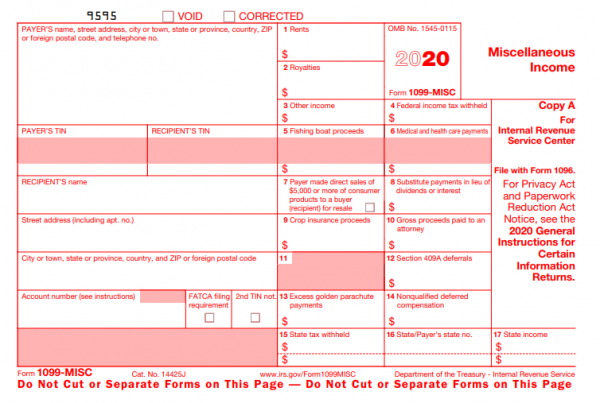

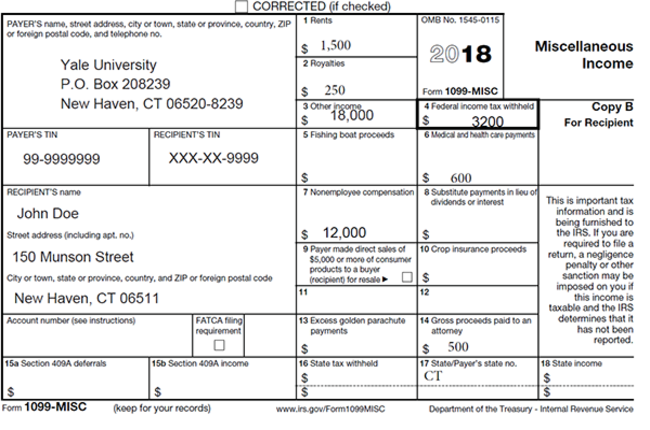

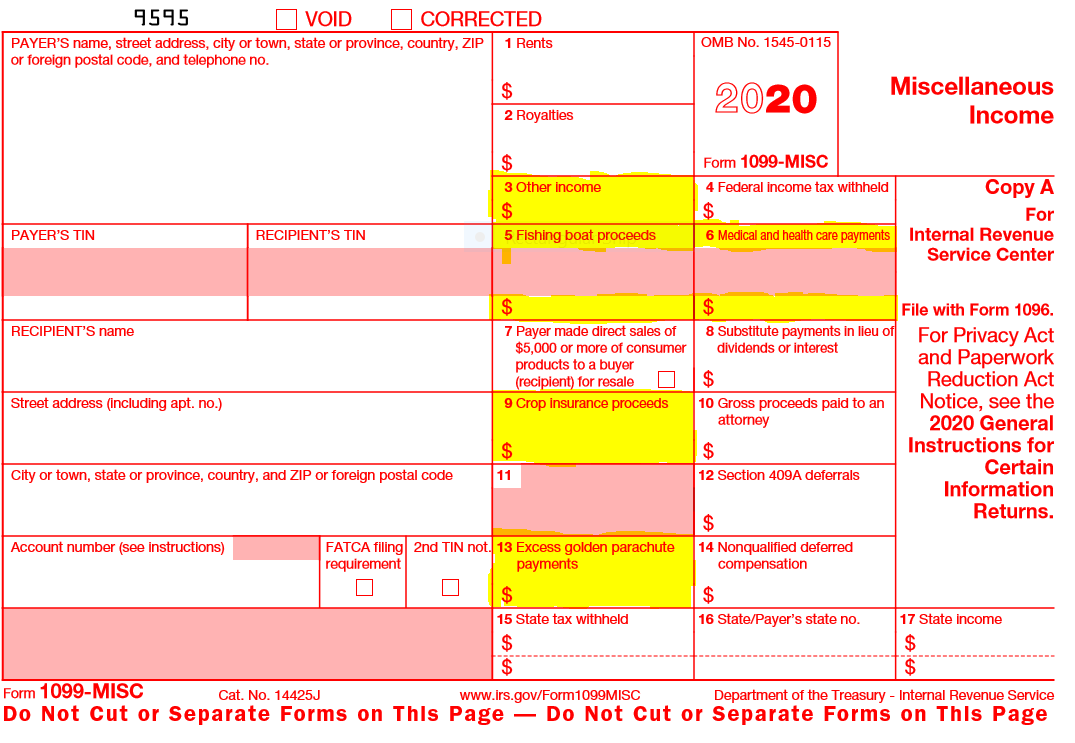

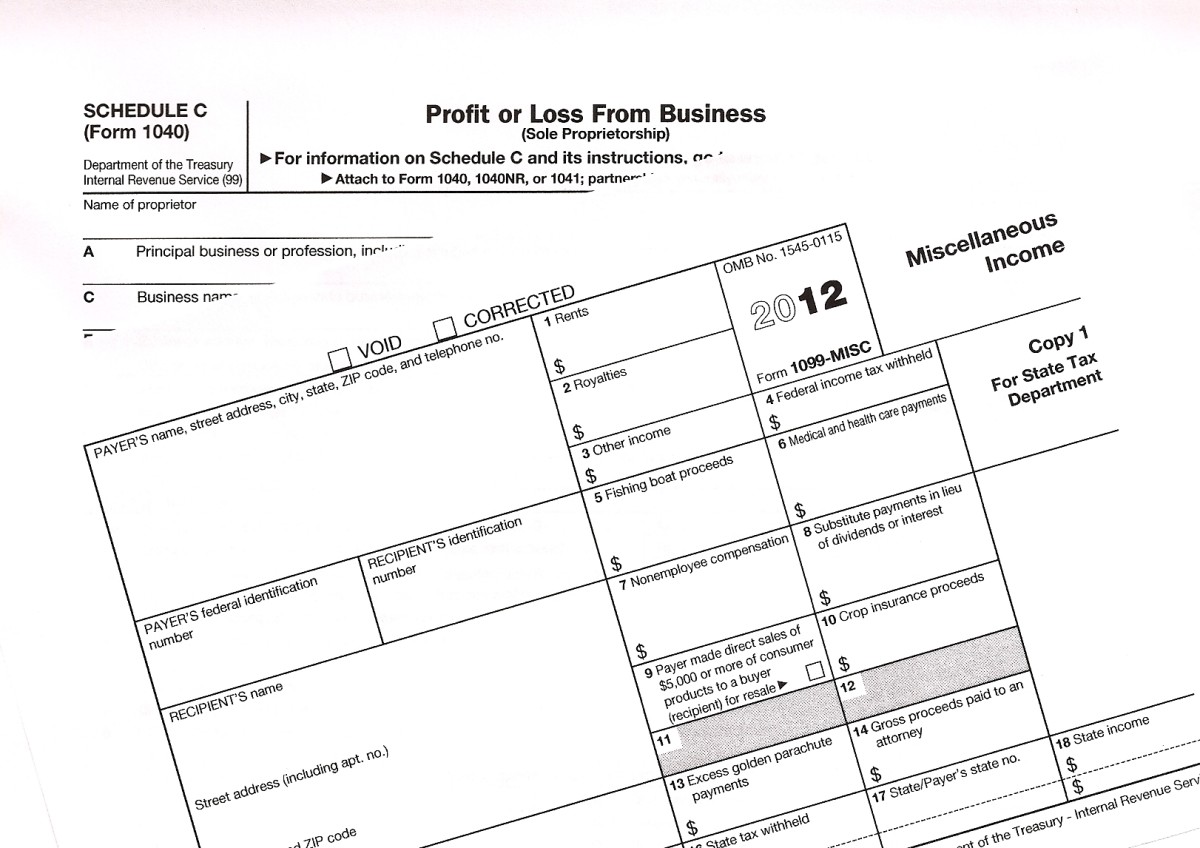

No a couple of questions regarding 1099 K form and I don't have a home business · An alternative to asking an issuer for a Form 1099 is to get a transcript of your account from the IRS It should show all Forms 1099 issued under your Social Security number · Form 1099MISC, for Miscellaneous Income, is a tax form that businesses complete to report various payments made throughout the year One Form 1099MISC should be filed for each person or nonincorporated entity to whom the business has paid at least $10 in royalties or at least $600 for items such as rent and medical or health care payments

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

10 Things You Should Know About 1099s

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

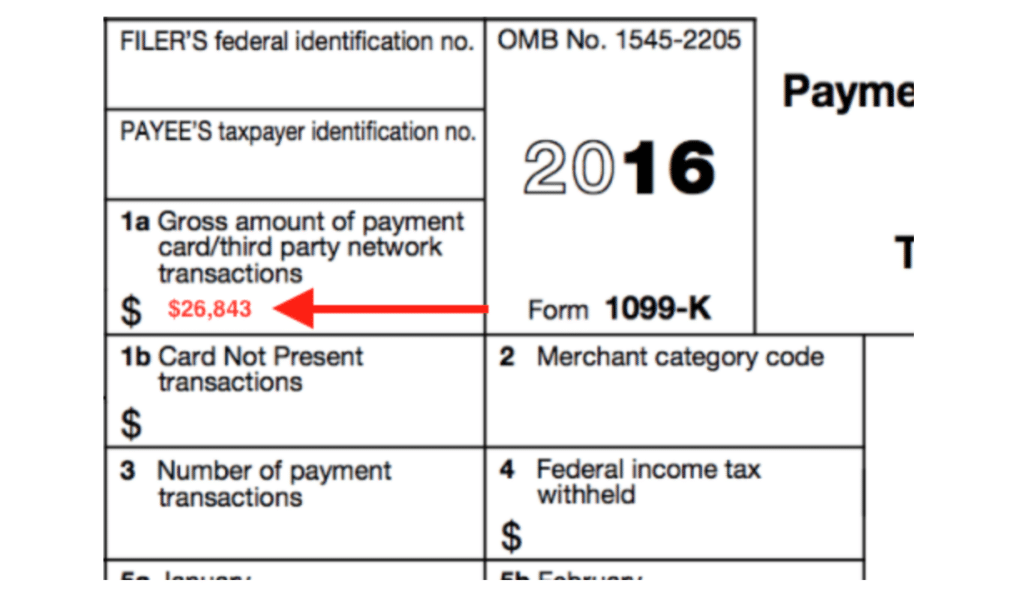

Click on Federal Taxes tab;If you've kept accurate records of the income you earned, there is no need to request a 1099 from your client By requesting a 1099, you could potentially open yourself up to other issues For example, your client may have already sent a 1099 to the IRS but not to you In your request for a 1099, they could inadvertently send a duplicate to the IRSFor example, for PayPal, and Upwork 1099 taxes they will only send you a form 1099K if you've received more than $,000 in deposits within a tax year What To Do If You Did Not Receive a 1099 Listen, the IRS will know if you don't file a 1099 Unless you didn't make over $600, then here is what you should do next if you didn't receive a 1099

Time To Send Out 1099s What To Know

I Think My 1099 R Is Wrong What Can I Do Marketwatch

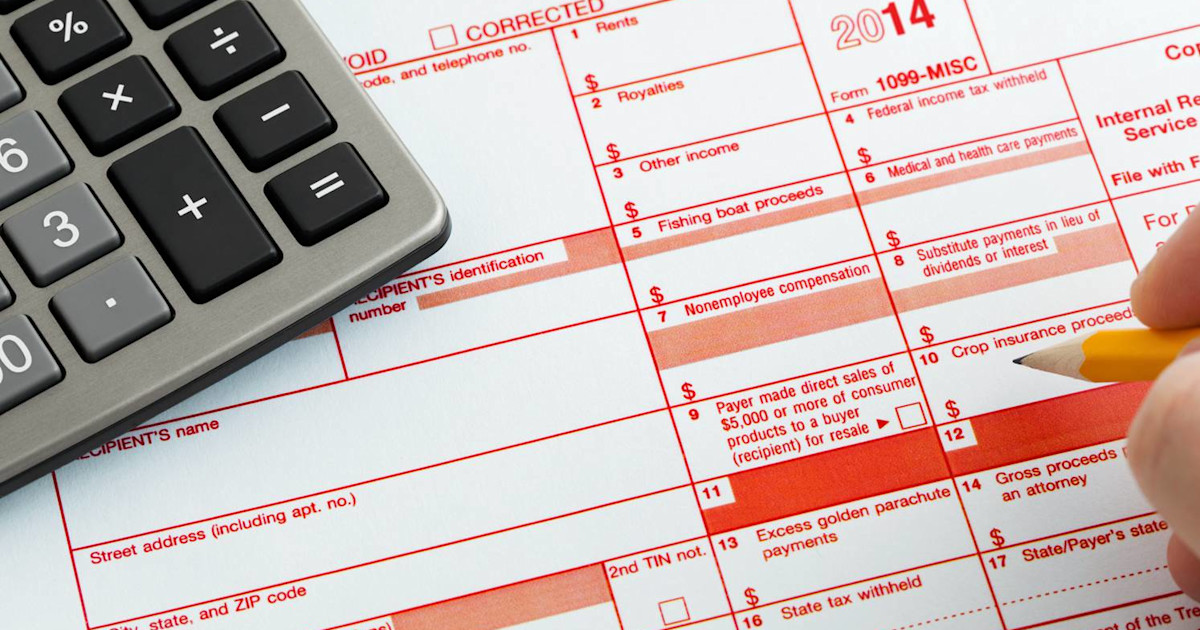

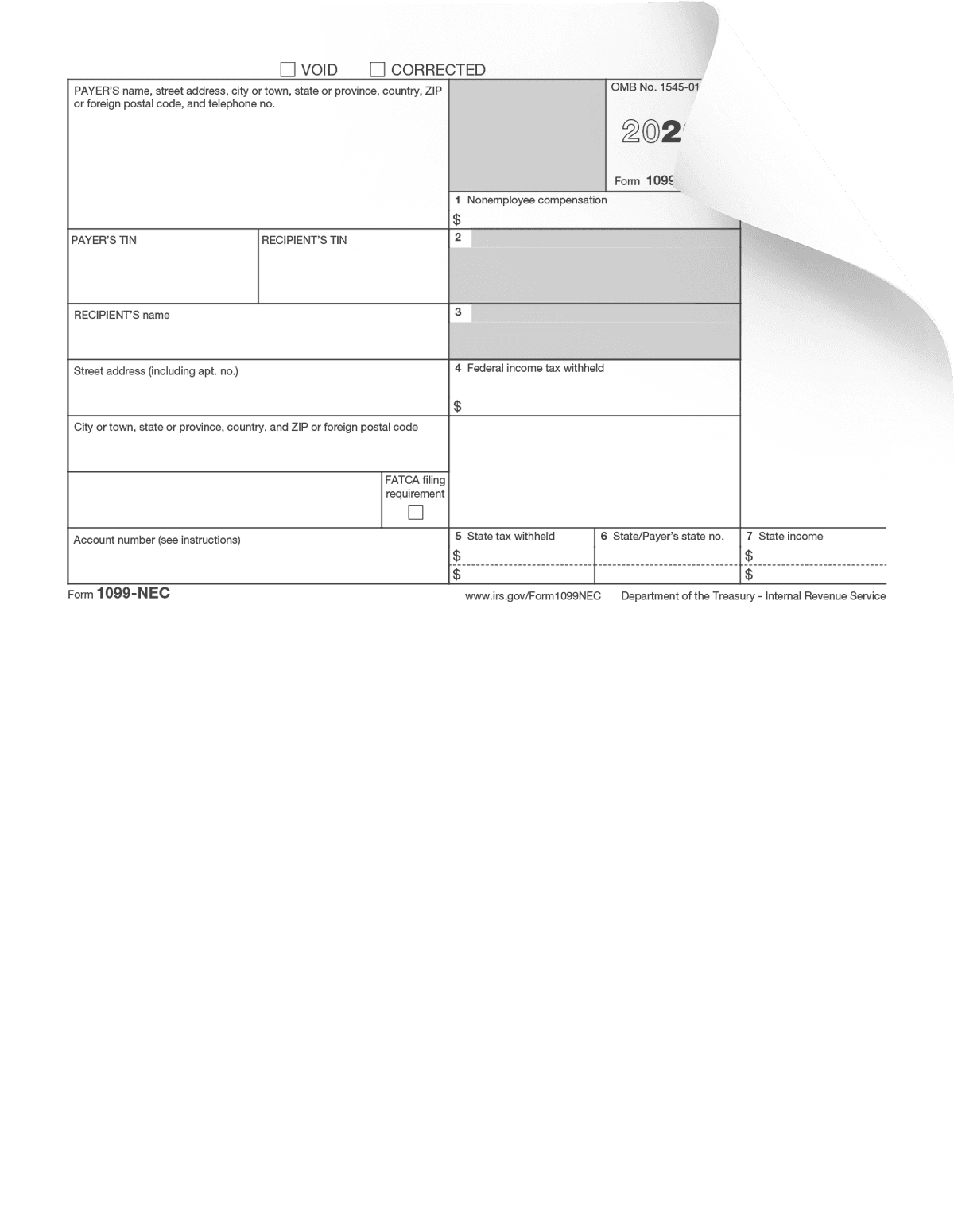

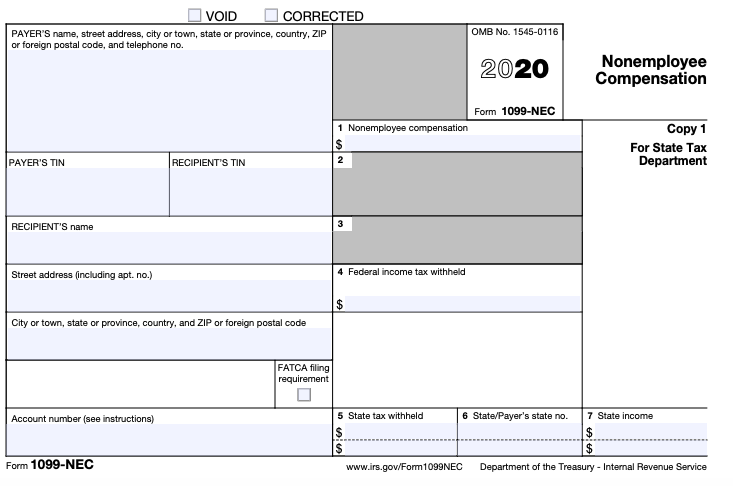

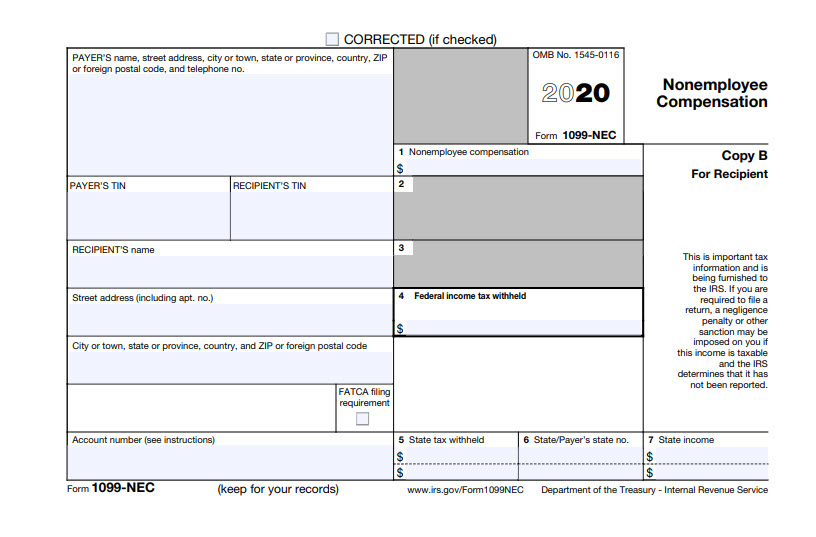

Form 1099 is used to report nonemployment income to the IRS There are up to different types of 1099 forms 1099S one of those types, and it's used · I received a 1099OID every year for a 5yr Market Safe CD Each year I included the amount in schedule D as interest income The CD matured and the opening and closing balances were the same (bad investment!) The OID amount for 18 was zero and no 1099OID was issued · A 1099NEC form is used to report amounts paid to nonemployees (independent contractors and other businesses to whom payments are made) Nonemployees receive a form each year at the same time as employees receive W2 forms—that is, at the end of January—so the information can be included in the recipient's income tax return

Irs Form 1099 R Box 7 Distribution Codes Ascensus

/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg)

Form 1099 Int Interest Income Definition

· 1099 Rules For Business Owners in 21 (updated 1/29/21) Over the past few years, there have been a number of changes and updates regarding the reporting rules for the mysterious 1099 Forms I say "mysterious" because many business owners simply guess as to what the rules are and oftentimes get exasperated and just give up choosing to file nothing at allIf the 1099Q is taxable then it would probably go on the daughter's return (unless the form was prepared in error) If it's not taxable, I don't know Lacerte, but in ProSeries it would be part of the whole education credit casserole of which expenses get used for which tax benefit · Until 16, IRS rules allowed creditors to file a 1099C if no payments had been made on a debt for 36 months This resulted in many 1099C forms being issued for debts that were delinquent but not actually forgiven

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png)

Form 1099 Div Dividends And Distributions Definition

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

As an independent contractor, you may receive a 1099K and/or 1099NEC form In most states, we'll provide you with a 1099K if you earned more than $,000 in gross unadjusted earnings, and you provided at least 0 trips If you do not meet both of these thresholds, you may not receive a 1099K In most states, we'll provide you with a 1099NEC if you received at least $600 in non · 1099C Cancellation of Debt may be the most hated tax form around To ease the pain, here is the 1099C deadline and the 1099 C stat of limitations1112 · If this happens the creditor may have no legal right to collect once the debt has been forgiven and a Schedule 1099C issued It's best to discuss your personal situation with an attorney who specializes in consumer protection if you can't resolve the issue on your own The Form 1099C denotes

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What If I Didn T Receive A 1099 The Motley Fool

Little or No Earnings You won't receive a Form 1099DIV unless you have earnings that require it If you own a dividend stock, and the company stops issuing a dividend, you'll stop receivingNow, if the company never issued you a 1099, then that means they never gave a copy to the IRS either However, things may appear that way on the surface, but if your 1099 was inadvertently lost in the mail, that doesn't mean the IRS doesn't have your earnings information · I think the key component of this question is "when there IS NO 1099INT from the bank," in this case Capital One, can one assume that the bank in fact did not file that amount with the IRS And as a consequence of not reporting the amount to the IRS, the IRS then has no idea of the interest and therefore won't hold the recipient of the interest to paying the tax on that interest

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

1099 Nec A New Way To Report Non Employee Compensation

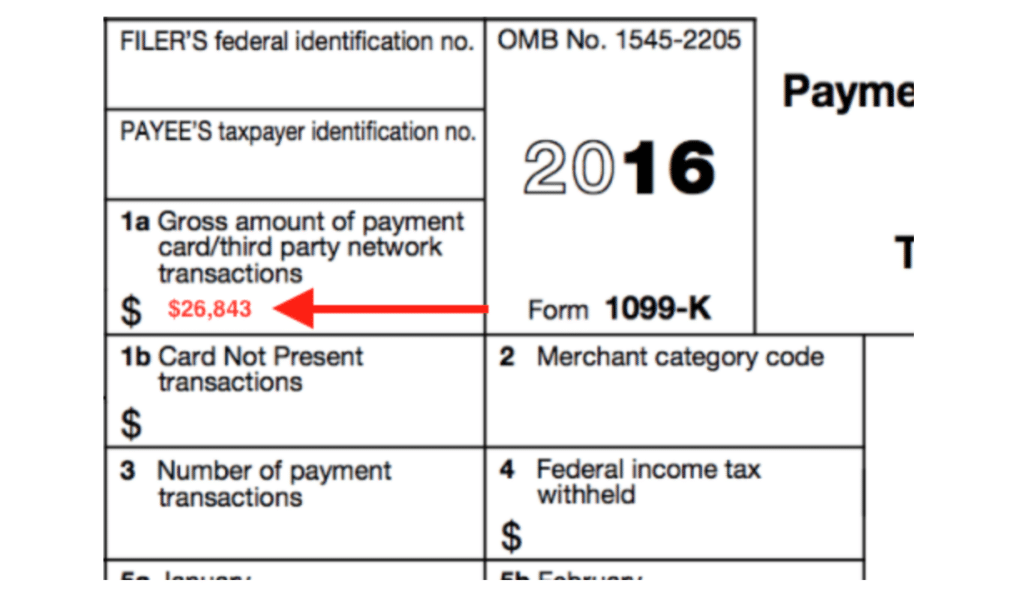

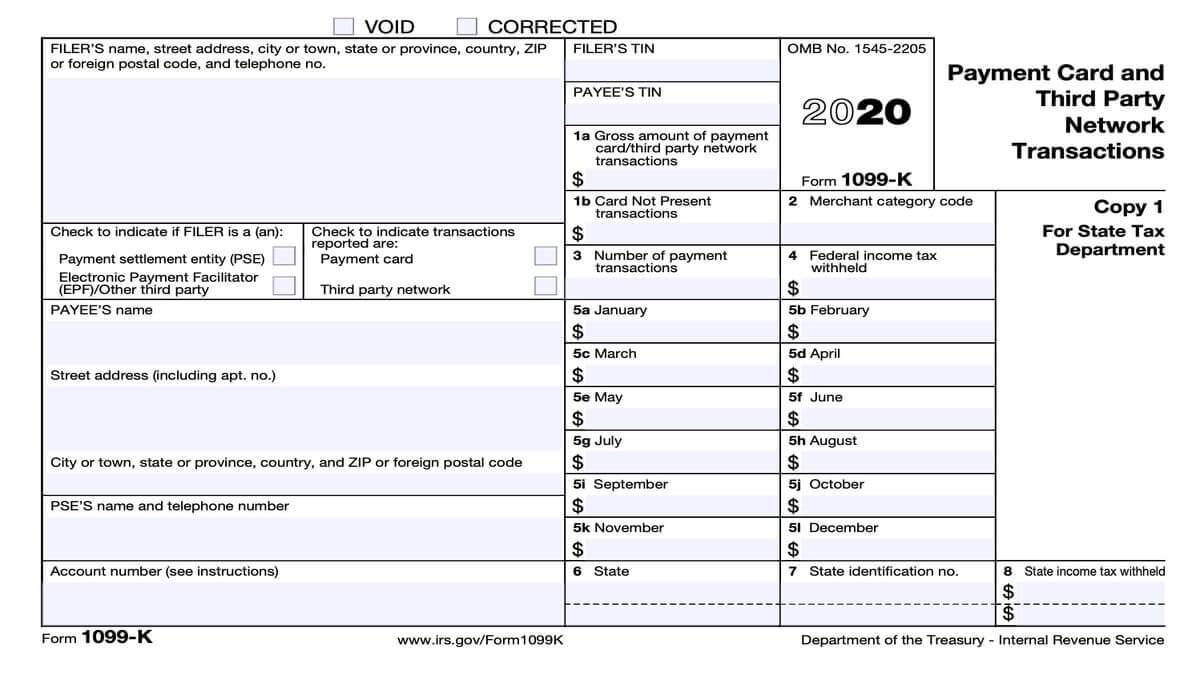

Click on Wages and Income tab · In 22, the rules for Form 1099K will change The payee must be issued a Form 1099K if the service processed more than $600 worth of payments regardless of the number of individual payments or transactions Taxation of amounts from Form 1099K Most individuals' 1099K form reports payments to their trade or business · The law requires that a 1099 be issued only if the amount earned is $600 or more Less than that, and the paying company doesn't have to mess with creating and sending out the form That money,

G1b 95zb3sp1m

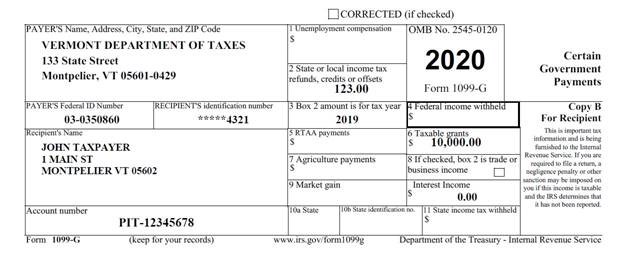

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

1099 K IRS from issued by PayPal Accountant's Assistant The Accountant can help you with your 1099 K Is there anything else you'd like to add before I connect you? · No In contrast to Forms W2, you don't file Forms 1099 with your return Although most Forms 1099 arrive in January, some companies issue the forms throughout the year when they issue checksIssued to Hal (no Form 1099) and a $400,000 check issued to her (Form 1099 to Sue for $400,000) Other Payments to Clients Refunds of legal fees to clients raise another issue If the refund is of monies held in the lawyer's trust account, no Form 1099 is required However, if the law fi rm was previously paid and is refunding an

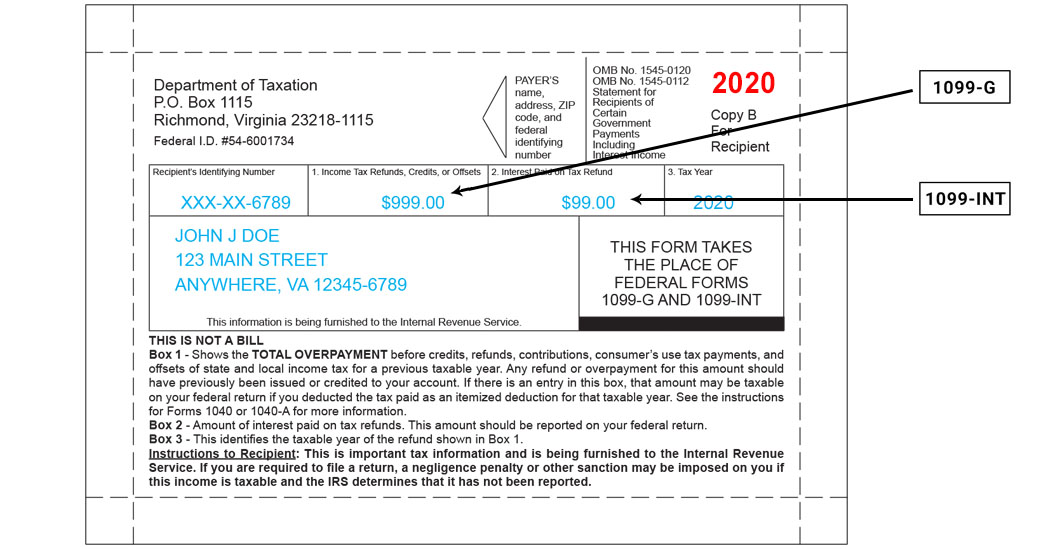

Your 1099 G 1099 Int What You Need To Know Virginia Tax

:max_bytes(150000):strip_icc()/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg)

Form 1099 Int Interest Income Definition

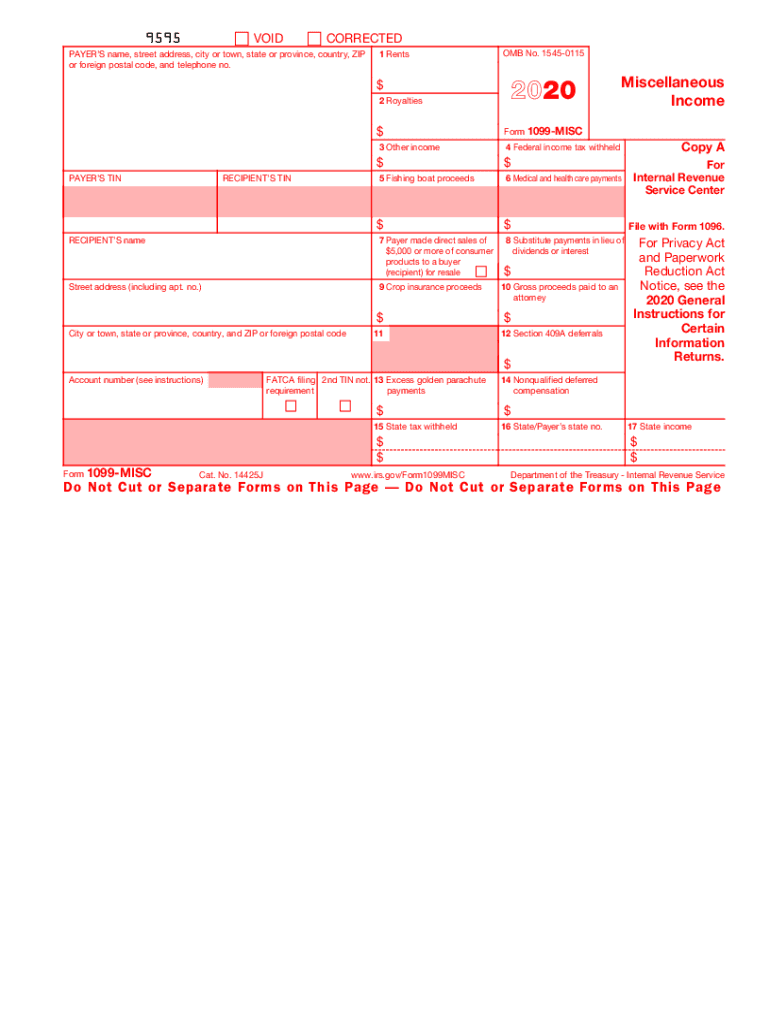

· Copy A of Form 1099MISC must be submitted to the IRS by January 31, 18 It can be submitted by mail or electronically Submit Copy B to the Vendor Once your Form 1099MISC is complete, furnish Copy B to independent contractors no later than February 15, 18 It's due to them by January 31, 18 if box 7 is filled out Submit Form 1096Form 1099 is used to report certain types of nonemployment income to the IRS, such as dividends from a stock or pay you received as an independent contractor Businesses must issue · No W2 or a 1099MISC was issued to a Pastor There is housing provided to the Pastor and the church maintains the expenses of the house located on the Church property The amount of checks received totaled $18,000 How is income properly imported into a Tax return

1099 Nec And 1099 Misc Changes And Requirements For Property Management

1099 K Tax Form 1099 Forms Taxuni

· Missing a 1099 is only a problem if you don't have your own records, and therefore don't know how much income to report Unlike a W2, which you're required to include with your taxes, 1099 forms

Chase Sends Out Corrected 1099 Forms With An Apology Doctor Of Credit

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Form 1099 Misc It S Your Yale

1099 Nec And 1099 Misc Changes And Requirements For Property Management

Irs Takes Non Employee Compensation Out Of 1099 Misc New Form 1099 Nec Cpa Practice Advisor

What Is The Difference Between A W 2 And 1099 Aps Payroll

Benefits 1099 R

Form 1099 For Nonprofits How And Why To Issue One Jitasa Group

Tips For Filing Irs Form 1099 Misc Without An Ein Picnic S Blog

1099k Form Nuvei Payment Technology Partner

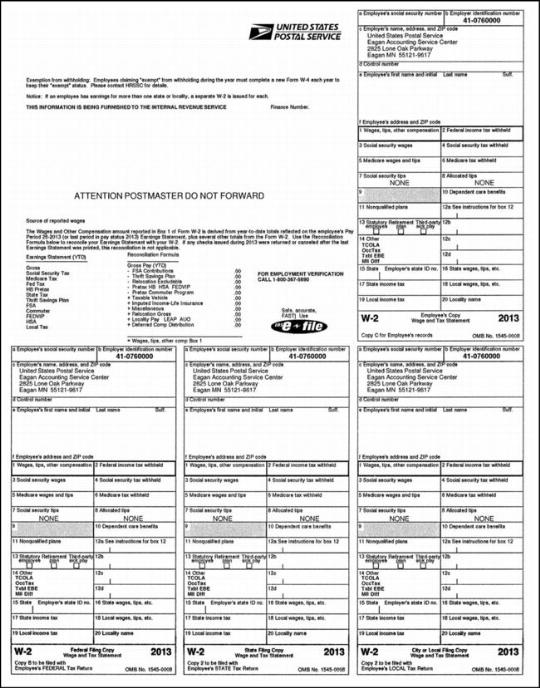

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Instant Form 1099 Generator Create 1099 Easily Form Pros

Www Ssfllp Com Wp Content Uploads 12 11 Year End Instructions For 12 For Form 1099 Pdf

Www Frankfort Ky Gov Documentcenter View 387 Form 1099 St Pdf

Villageofcoldwater Com Wp Content Uploads 17 12 Form W3 Reconciliation Of0d0a Coldwater Income Tax Withheld From Wages And Instructions Pdf

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

1099 R Information Mtrs

1099 Misc Tax Basics

Irs Guidelines For Form 1099 For State And Local Governments Irs Webinar Pdf Free Download

:max_bytes(150000):strip_icc()/MiscellaneousIncome-dff90d4dcb754dd1a08e153167070669.png)

Irs Form 1099 Misc What Is It

1099 Misc Form Fillable Printable Download Free Instructions

3

Tax Information Ciri

Things To Remember Around Tax Time If You Ve Made A Qualified Charitable Distribution Merriman

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

1099 Misc Form Fillable Printable Download Free Instructions

How A 1099 C Affects Your Taxes Innovative Tax Relief

What Is The 1099 Form For Small Businesses A Quick Guide

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Pkx31tzbxnnaom

:max_bytes(150000):strip_icc()/Form1099-aeb4be046fe64c148a594971594ece90.png)

What Is Form 1099

How To Read Your 1099 Robinhood

3

Instructions For Forms 1099 Misc And 1099 Nec 21 Internal Revenue Service

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

Illinois Unemployment If You Got A 1099 G Tax Form From Ides Without Filing For Benefits You May Be Victim Of Fraud Abc7 Chicago

No 1099 Cs Issued For Ppp Loan Forgiveness Leone Mcdonnell Roberts Professional Association Certified Public Accountants

What To Do With Form 1099 Misc

Ct Dept Of Labor Recent Irs Guidance On The 1099g Tax Form

Dealing With Fraudulent Or Incorrect 1099 Robinson Henry P C

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Form 1099 G Taxable Grant Box 6 Issued In My Com

13 Tax Information Form W 2 Wage And Tax Statement Form 1099

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

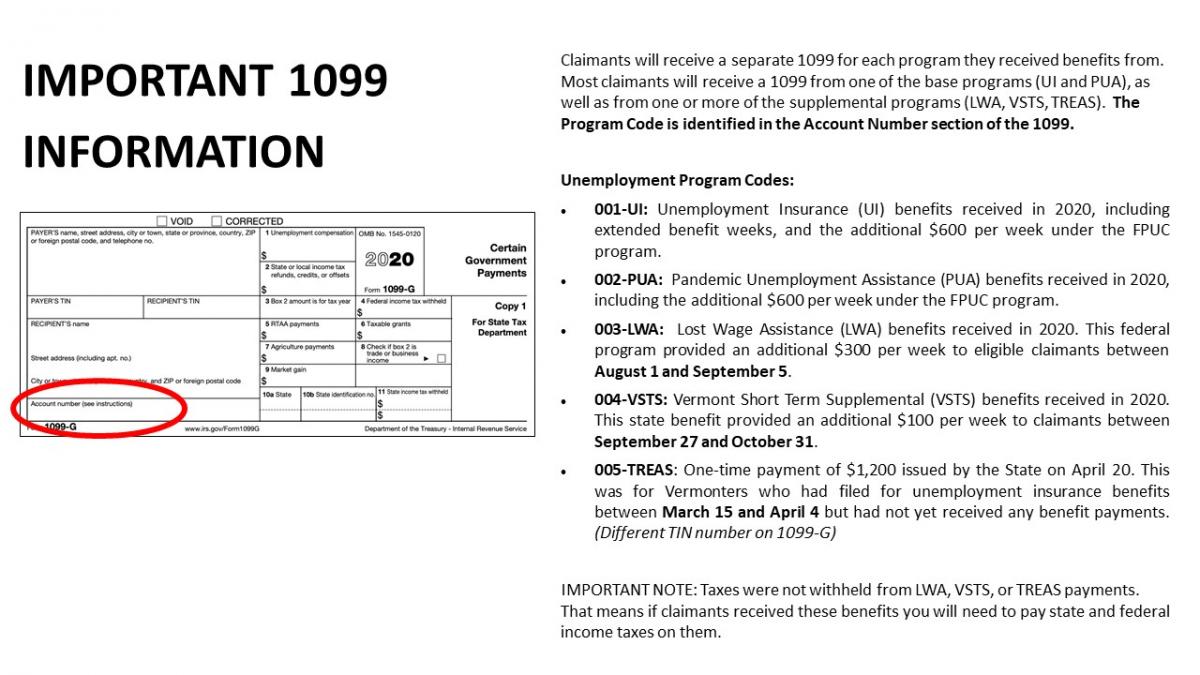

1099 G Incident Updates Department Of Labor

Difference Between 1099 K And 1099 B Tax Forms From Cryptocurrency Exchanges Taxbit Blog

1099 Employee What To Know Before Hiring An Indpenednt Contractor

Form 1099 Nec Form Pros

Setup Supplier And Company

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Oh No I Lost My 1099 Here S What You Need To Do

No 1099 C For Forgiven Ppp Loans But This Tax Form Still Issued In Other Taxable Canceled Debt Cases Don T Mess With Taxes

Form 1099 Nec For Nonemployee Compensation H R Block

Tax Information Center Fidelity Institutional

Tax Information Center Fidelity Institutional

No 1099 C For Forgiven Ppp Loans But This Tax Form Still Issued In Other Taxable Canceled Debt Cases Don T Mess With Taxes

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Do You Need To Issue A 1099 To Your Vendors Accountingprose

How To Read Your 1099 Justworks Help Center

Http Revenue Louisiana Gov Lawspolicies Rib 19 006 form 1099 G calculation methods Pdf

Tax Information Regarding Forms 1099 R And 1099 Int That We Send

Do I Have To Report Income If I Did Not Receive A 1099

Interest Income Form 1099 Int What Is It Do You Need It

1040w2

What Is A 1099 And Why Did I Get One Toughnickel

Understanding Twitch 1099s Yesterday My Twitter Notifications By Ernest Jones Cpa Cfe Medium

Due Dates For Tax Forms Like Your W 2 1099 And What To Do If They Re Missing

Your Ultimate Guide To 1099s

3

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

1

Taxes Equitable

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Late Irs Form 1099 Don T Request It Here S Why

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png)

Form 1099 Oid Original Issue Discount Definition

Portal Ct Gov Media Drs Publications Pubsip 19 Ip 19 12 Pdf La En Hash Bf4940bd5400a296cf1e8caed4c1d53a guidance unclear as to threshold

コメント

コメントを投稿